The Impact of Coronavirus on Investments

Coronavirus in Context

The last few weeks have been quite the ride for us all, with endless headlines about the coronavirus everywhere you turn.The virus has been disruptive for individuals and businesses alike with many businesses scrambling to adapt to working from home and having to adjust to a radically different lifestyle that is likely to last for some months.

What impact will Coronavirus have on investors?

The impact on your pensions and investments will depend on a number of factors;

Firstly of course their performance will be subject to the macroeconomic environment including the reaction of governments across the world and any amendments to monetary and fiscal policy.

Secondly and the most crucial factor that will impact your investments is how we as investors react during this time.

Thirdly the structure of your portfolio (how it is invested) will effect the growth attained or damage caused by macroeconomic movements.

A well-diversified portfolio will help to limit losses in harder times as well as positioning your investments to be able to benefit from uplifts in the future.

The Importance of well-diversified and ethically based portfolios

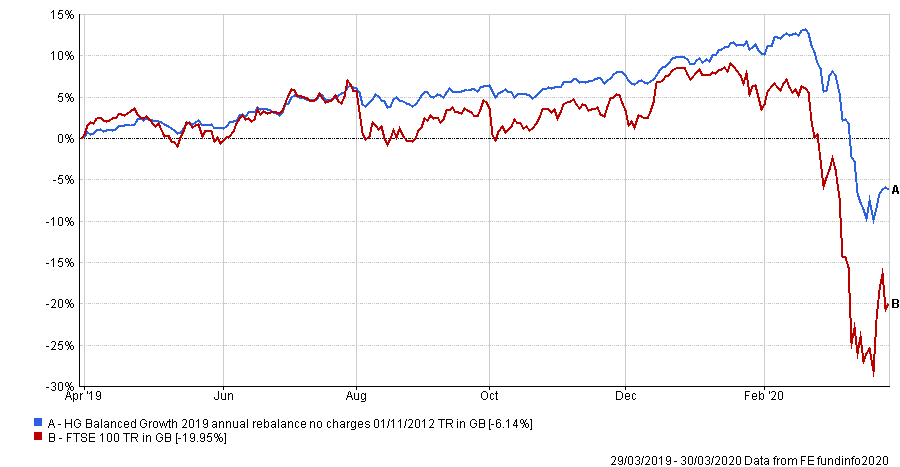

Our portfolios are built to limit the effects of difficult market conditions and, although they have not been immune to the recent steep drops in value, they have not suffered as severe an impact as for example, the FTSE 100 Index (which is largely used as a gauge of prosperity for businesses regulated by UK company law), as illustrated in the graph below.

As well as this, having an ethical screen embedded into our careful asset allocation and wide diversification has also protected us from some of additional threats such as the volatile oil market.

Way Forward

In these testing times it is important to remind ourselves of the time horizons we are investing for and original purpose of these funds. If you have a specific need or emergency situation that might call for disinvesting in the next 3-6 months please contact us to discuss the best strategy to go about that. Otherwise please remain calm and let your portfolios do their job to make sure you are in the best possible position to benefit from the recovery.

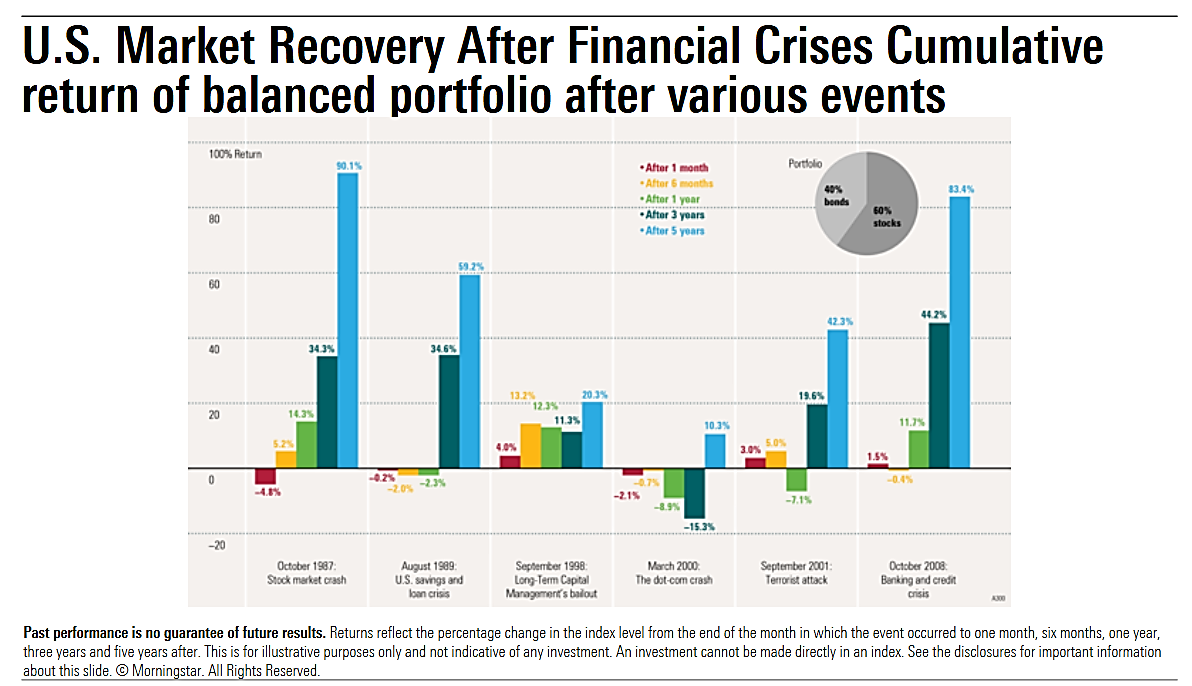

Although the root cause of the current situation is new and has been more unsettling and disruptive to many individuals and businesses across the globe than previous corrections, the effect on global markets has been very similar. The dot com crash of 2000, the financial crash of 2008 or even the SARs outbreak engendered very similar periods of initial panic.

The below chart by MorningStar shows the US market recovery after past financial crises and illustrates that investors who ‘ride the storm’ and let their balanced portfolios do the work benefit greatly in the recovery, In the case of the 2008 financial crash investors had made back their losses within a year.

Thus although It is easy to see why some investors’ gut reaction would be to consider making changes to their portfolios or withdrawing amid the losses the market has experienced, the effect of this would essentially be to lock in the temporary dip effectively converting it into a permanent loss and giving the investor no chance of participating in the recovery.

Get in Touch & Stay Tuned

Please be reassured that we continue to strive to protect your holdings whilst simultaneously positioning our portfolios to provide maximum potential to recover quickly from this difficult period, as we appreciate your investments represent your lifelong efforts and disciplined savings.

We will be keeping a watchful eye on developments and will be posting further articles on our insights as well as any measures that may help individuals and businesses over the next couple of months.