;,How Covid-19 can kick-start your financial well being

The Covid-19 global pandemic has been a huge challenge for us all. Some people have been, or are, losing their jobs or livelihood. The FTSE, Dow Jones and the Nikkei have experienced significant drop. Whilst isolating during the lockdown has had effects on our most vulnerable family and friends.

However we firmly believe that this shocking set of events could be the catalyst for many to take steps towards better financial planning. These steps could actually make a real positive difference to their lives in the long term.

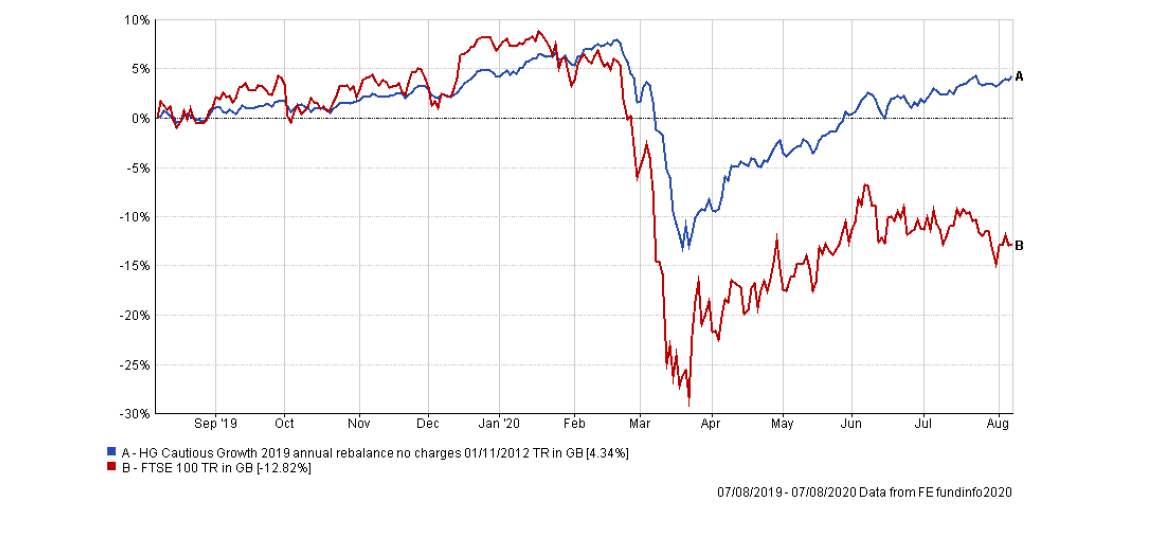

After all, if there is anything we have learnt it is that the unexpected does happen. Those who had not yet ensured that their pensions and investments were invested appropriately and well diversified have certainly felt the sting during this pandemic. This is clearly illustrated below.

Spotlight on pensions and personal investments

The pandemic and resulting stock market fluctuations have caused many to take a closer look at their pensions and other investments. Suddenly many people have come to realise their pension’s risk level is too high, or the charges levied on their savings are unnecessarily high. Some have simply been disappointed by low levels of growth or that they are not invested in line with their beliefs.

Perhaps more disturbingly is that some people have realised that they do not actually know how their pension is doing – or how realistic their retirement plans are. Many of those still in a more traditional pension scheme have been facing closure or are under threat. Others in newer pension schemes are often dealing with a confusing array of options that are hard to understand or be confident about.

A great time to reassess and take action

At HG Financial Planning we are working with our clients to not only ensure that they survive but that they thrive coming out of lockdown. Now is the time to ask ourselves some hard questions:

- Do you have a clear idea of your financial plan?

- If so have you confirmed how realistic they are?

- Do you have a plan b and;

- Do you know what the best steps to take are to reach your goals?

Another less obvious question is;

Are you making good use of the government and other useful schemes and incentives which could make a significant difference?

Take the opportunity to re-assess – Book a Review.

We are dedicated to providing clear and honest service and believe that our services are needed now more than ever. As such we are offering a free comprehensive and no obligation review during the Covid-19 crisis.

Included within this review is a full investigation of any existing policies where we will assess the performance, risk level and costs as well as provide suggestions for improvements where necessary.

Where desired we can also provide a basis cash flow analysis which will give you an estimation of how realistic your retirement plans are or how much you would need to build up to achieve your goals.